Why is financial analysis important? The answer is quite simple. It offers businesses a glimpse into their whole financial situation. Where your finances come from, where they go, whether you have any debts, etc. It can even predict the possible profitability of specific projects and campaigns.

To reap the benefits of it, partnering up with companies such as Research Optimus is your best bet. There’s so much more to financial analytics than meets the eye, so outsourcing it is often the smartest choice.

Why Is Financial Analysis Important in Business?

Since financial analytics provides you with a clear and detailed insight into your business finances, it allows you to improve your business performance. Information is power, and analyzed financial data gives you the ability to make strategic decisions. You can evaluate the sustainability of your projects, determine their performance, and predict their economic outcomes.

Financial analysis can prove to be of utmost importance to finance managers, top management, trade creditors, investors, labor unions, and others.

You can analyze the financial strengths and weaknesses of your business and assess your operational efficiency. You can determine your liabilities and study the reasonability of stock and debtors, as well as appraise individual performances, analyze your budget, minimize your losses, and increase your revenue.

Uses of Financial Analytics

There are four main uses of financial analytics software, and they include:

- Reviewing the company performance over time

- Assessing the current operational efficiency

- Predicting growth

- Assisting loan decisions

To ensure the success of your company, you must have insight into past performance. This includes analyzing sales, your past ROI, operating expenses, debt-to-equity structure, and more.

The overview of your current situation will help you determine your business’s financial health, which will assist you in making the best strategic decisions.

Predictive analysis will allow you to set your business on a path to success. With the probable gains and losses in front of you, you can determine the best course of action.

And finally, financial analysis will assist you in getting approved for loans and credits. It will show your credit risk, and you can use the information to get the best interest rates and favorable terms and conditions.

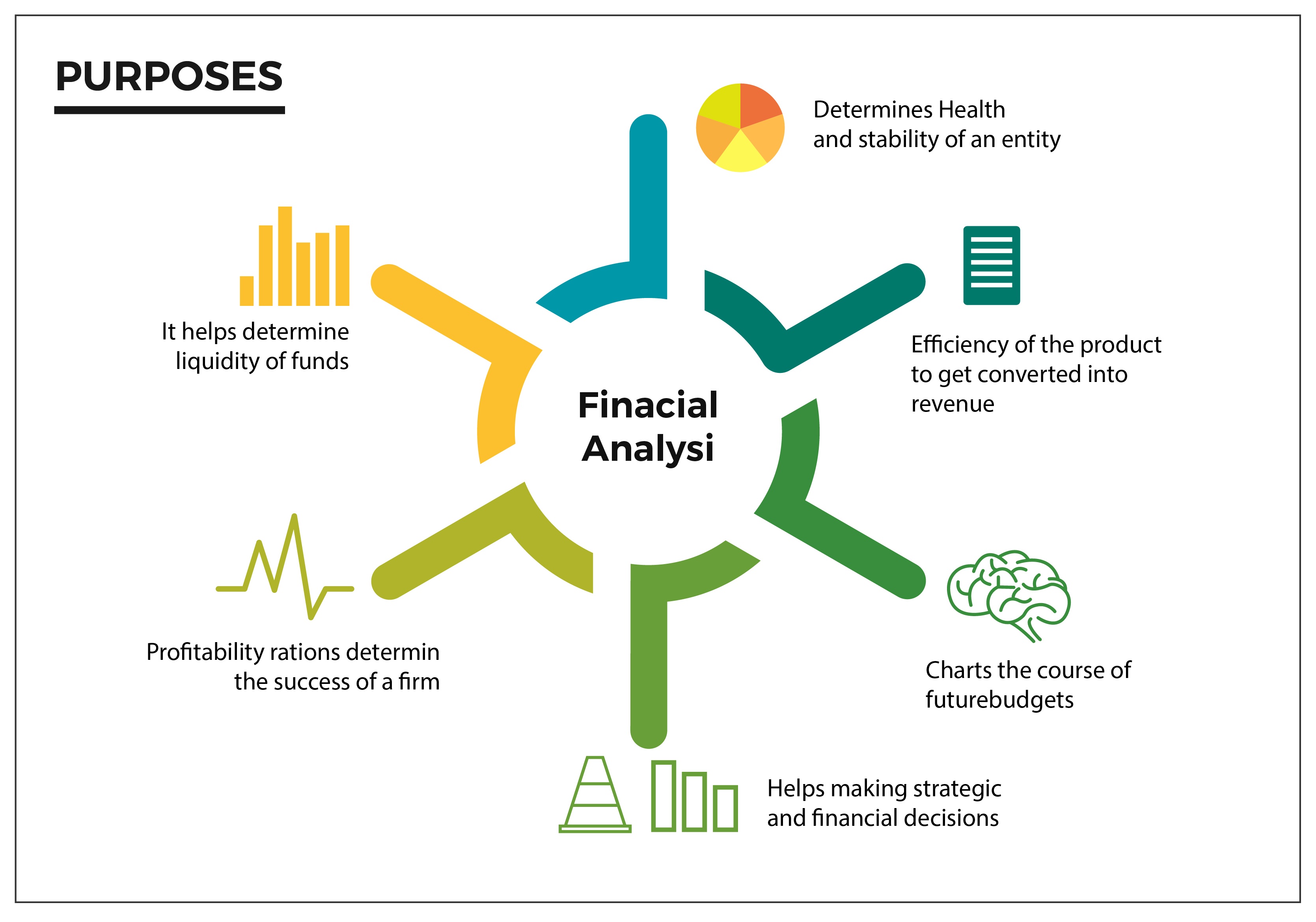

Purpose of Financial Analysis

Those still wondering why financial analysis is essential should know that the information provided by this software allows you to understand your business better.

Investors can determine the investment value of a business, and see if it’s worth their time and money. Past and current balance sheets, income statements, and cash flow statements help them predict future performance and potential for growth.

You can determine the solvency of your business, your return on equity, price to earnings ratio, weigh the effects of borrowing or taking out a loan, and more.

Determine your potential risks, and use the information for planning out a detailed strategy that will guide you to success.

Financial Analysis Helps in Calculating Business Profit

Financial analysis takes into account all financial information regarding your business. It primarily focuses on:

- The income statement

- Balance sheet

- Cash flow statement

Now, when it comes to the income statement, it’s important for many reasons. It shows your business’s revenue, profit, and any tax information. Your income statement is your profitability. It gives you insight into all your financial losses and gains over some time.

Your balance sheet shows your current financial position. It lists your assets, your liabilities, includes your solvency ratio, and reveals your debt-to-equity ratio. This accounting statement is used for analyzing either your whole company’s financial position or an individual’s position.

Lastly, your cash flow statement presents you with the information on how your money is allocated, and it reveals your liquidity. Your cash flow is distinguished from your other expenses, such as operations, investing, and financing activities.

No one of these individual statements will give you adequate insight into your company’s situation. To understand your exact financial position, financing activities, investing, operating, and profitability, all three of these statements must be put together. Only when they’re combined can you get the full picture and improve your decision-making processes.

Any profits or losses in the income statement will reflect in the balance sheet through assets and liabilities. Any changes in your cash flows will affect the information presented in the income and balance sheets. It all works together.

Financial Analysis Software and Their Usages

Now, doing a financial analysis manually is next to impossible, especially for growing businesses whose financial situation is continuously fluctuating. It would take excess time and money to collect the necessary information, analyze it, and present it in an easy-to-digest manner.

This is where financial analysis software comes in handy. Companies such as Research Optimus rely only on the best software currently available on the market. The best software is secure, accurate, and presents the information in a better way.

FinAlyzer

If you have a multitude of business lines, entities, or reporting requirements, this is the software that will be the most useful to you. FinAlyzer will help you automate your financial consolidation, segment profitability, management and financial reporting, and dash-boarding. It’s rather easy to set up and integrate into your existing network and is cost-effective.

Board

Board will help you make informed decisions about your business, and set you on a path to success. This software centralizes data sources, unifies business intelligence, planning and advanced analytics, and performance management.

Float Cash Flow Forecasting

An award-winning solution, Float Cash Flow Forecasting allows you to forecast your financial situation up to 3 years into the future. You can gain insight into your cash flow on a daily, weekly, or monthly basis, and the information is easy to share with banks, investors, and boards.

Conclusion

Precise and accurate financial statements will allow you to analyze your business’s performance and assist you in your decision-making process. New software solutions provide you with speed, accuracy, and efficiency. Outsourcing your financial analytics to Research Optimus will ensure you can quickly adapt to changes in the market and stay ahead of the competition.