The mortgage industry is changing, and so is the way lenders do business. The days of paper-based transactions are over, and more and more lenders—especially larger ones that deal with a large volume of loans are turning to software to streamline their processes.

With that in mind, take a look at what modern loan origination software should include in order to be the most efficient for both lenders and borrowers alike.

One centralized system for the entire origination process

The first thing you should look for in a origination software is that it’s one centralized system.

One centralized system for the entire origination process means that all aspects of your business are managed in one place, so there are no holes or gaps where information isn’t being tracked. Everything you need to do your best work can be accessed from one central location, making it easier and more efficient to manage the entire operation.

Automated and customizable workflow

The second feature you want to look for is automated workflow. The most efficient lenders are those who have custom workflows. Workflow refers to a sequence of steps that are performed in order and then repeated at set intervals.

For example, your team may have a workflow where once the borrower completes their application, it is sent out for underwriting approval from either an internal or external source.

Then, once the underwriting approval has been received back into the system, it can be followed by document uploads and funding requests—all before being sent out for final approval. This process will continue until all necessary steps have been completed and funded.

E-signatures

As e-signatures become more commonplace, you should be prepared to include them in your operations. They can cut down on the time and effort required to close loans, as well as help with efficiency when signing documents internally.

Lenders should also consider adding e-signatures to their internal processes, especially if it’s something they haven’t done before or have been hesitant about doing. One example is using electronic notarization for internal documents such as offer letters and employment agreements.

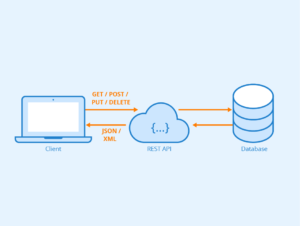

Data Import/Export capabilities

Data import and export is an essential function in any origination system. It allows lenders to populate data fields from other systems (e.g., credit bureau or other external sources) and then easily export that information for use by other systems.

For example, a lender may choose to import loan application data from their ERP (Enterprise Resource Planning) system into the Origination Software for review by underwriters, who then send their recommendations back out to the ERP system for processing into a complete loan application.

In another scenario, a mortgage broker may use the origination software as an input tool during his home buying process. Once he has determined which properties he would like to view in person or obtain more information on, he can export his search results into an Excel file that contains all of his property selections with contact details and driving directions included.

Analytics and reporting tools

Finally, you need analytics and reporting tools. Your origination software should be able to track all relevant metrics, including but not limited to:

- Loan volume

- The number of loans originated each month

- The number of loans closed each month

Conclusion

Loan origination software is a must-have for any financial services firm that deals with loans on a regular basis. This type of software streamlines workflows, increases efficiency and productivity within your organization, and helps you provide better customer service.

When choosing the right lender software platform for your business, be sure to consider all five features listed above: one centralized system for the entire origination process; automated and customizable workflow; e-signatures; data import/export capabilities; and analytics & reporting tools. With these features in place, lenders can improve their service levels while saving time!